All Categories

Featured

Table of Contents

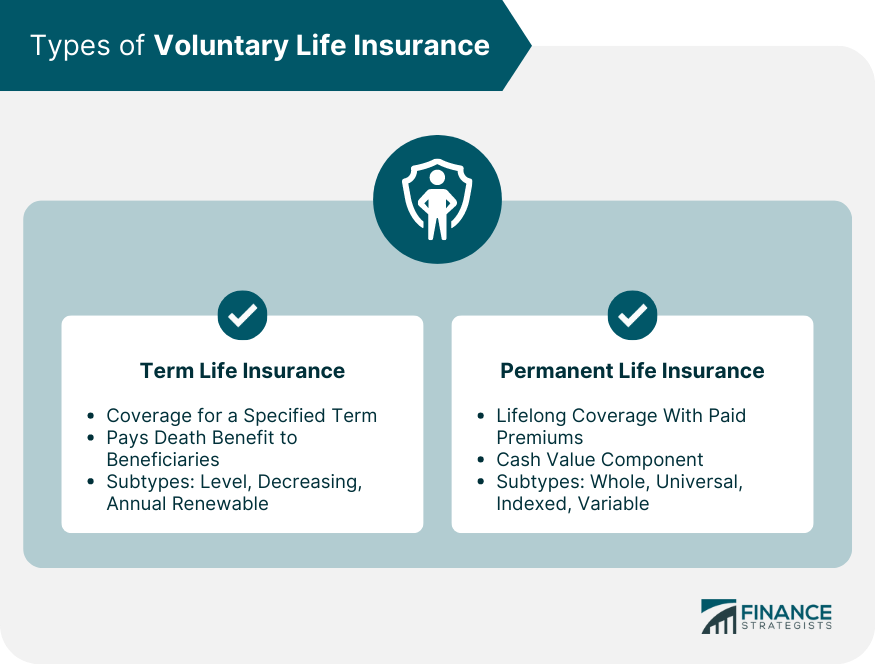

That normally makes them a much more inexpensive option for life insurance policy coverage. Some term plans might not maintain the costs and fatality profit the very same with time. Annual renewable term life insurance. You do not want to mistakenly think you're acquiring level term protection and after that have your fatality benefit adjustment later. Many people obtain life insurance policy coverage to aid monetarily secure their enjoyed ones in instance of their unanticipated fatality.

Or you may have the choice to convert your existing term protection into a permanent plan that lasts the rest of your life. Various life insurance policy plans have potential advantages and drawbacks, so it's essential to comprehend each before you determine to buy a plan.

As long as you pay the costs, your recipients will get the survivor benefit if you pass away while covered. That stated, it is very important to keep in mind that most policies are contestable for 2 years which suggests coverage might be retracted on fatality, needs to a misstatement be located in the application. Policies that are not contestable usually have actually a graded survivor benefit.

What Exactly is What Is Direct Term Life Insurance Policy?

Premiums are generally lower than entire life plans. With a degree term plan, you can pick your protection quantity and the plan size. You're not locked right into a contract for the rest of your life. Throughout your policy, you never ever have to fret concerning the premium or fatality benefit amounts altering.

And you can't squander your plan throughout its term, so you will not get any kind of monetary take advantage of your previous insurance coverage. Similar to other sorts of life insurance policy, the cost of a degree term plan relies on your age, insurance coverage demands, work, lifestyle and health and wellness. Usually, you'll locate much more budget-friendly protection if you're younger, healthier and much less risky to guarantee.

Because level term costs remain the exact same for the duration of protection, you'll recognize specifically how much you'll pay each time. Level term protection additionally has some adaptability, permitting you to customize your plan with extra functions.

What is the Role of Life Insurance?

You may have to meet particular problems and certifications for your insurer to establish this cyclist. There likewise might be an age or time limit on the insurance coverage.

The survivor benefit is typically smaller, and insurance coverage usually lasts up until your child transforms 18 or 25. This biker may be a much more cost-effective method to help ensure your children are covered as bikers can frequently cover multiple dependents at as soon as. When your youngster ages out of this insurance coverage, it might be possible to convert the cyclist right into a brand-new policy.

The most usual type of irreversible life insurance policy is entire life insurance coverage, yet it has some key distinctions compared to degree term coverage. Right here's a standard introduction of what to consider when contrasting term vs.

What is Level Premium Term Life Insurance? A Beginner's Guide

Whole life insurance lasts for life, while term coverage lasts insurance coverage a specific period. The costs for term life insurance coverage are usually reduced than entire life coverage.

One of the primary attributes of level term insurance coverage is that your costs and your fatality benefit don't change. You might have insurance coverage that begins with a fatality benefit of $10,000, which can cover a mortgage, and after that each year, the fatality benefit will decrease by a collection quantity or percentage.

Due to this, it's usually an extra budget-friendly type of degree term coverage., but it might not be enough life insurance policy for your needs.

Everything You Need to Know About Term Life Insurance

After deciding on a plan, complete the application. If you're accepted, authorize the documents and pay your initial premium.

You may want to upgrade your beneficiary info if you have actually had any significant life adjustments, such as a marriage, birth or separation. Life insurance policy can in some cases feel challenging.

No, level term life insurance policy does not have cash money worth. Some life insurance coverage plans have a financial investment function that allows you to construct cash value over time. A section of your costs payments is set apart and can make passion in time, which expands tax-deferred during the life of your coverage.

You have some alternatives if you still desire some life insurance protection. You can: If you're 65 and your protection has actually run out, for instance, you may want to get a brand-new 10-year degree term life insurance policy.

An Introduction to Annual Renewable Term Life Insurance

You might be able to transform your term protection right into an entire life policy that will last for the remainder of your life. Many kinds of degree term plans are exchangeable. That means, at the end of your protection, you can transform some or every one of your policy to entire life protection.

A degree costs term life insurance coverage strategy allows you adhere to your spending plan while you aid shield your household. Unlike some stepped price plans that enhances each year with your age, this sort of term strategy offers prices that remain the very same for the duration you choose, also as you age or your health and wellness modifications.

Find out more regarding the Life Insurance alternatives readily available to you as an AICPA participant (Term life insurance with accelerated death benefit). ___ Aon Insurance Coverage Services is the brand for the broker agent and program administration procedures of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Solutions Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc .

Latest Posts

Instant Insurance Life Quote

Final Expense Insurance Quotes Online

Funeral Insurance Policy Cost