All Categories

Featured

Table of Contents

Insurer won't pay a minor. Rather, take into consideration leaving the cash to an estate or depend on. For even more comprehensive info on life insurance coverage get a copy of the NAIC Life Insurance Policy Buyers Overview.

The IRS places a restriction on how much money can go right into life insurance policy premiums for the policy and how promptly such costs can be paid in order for the policy to retain every one of its tax obligation benefits. If certain limits are gone beyond, a MEC results. MEC insurance holders may go through taxes on distributions on an income-first basis, that is, to the extent there is gain in their plans, as well as fines on any type of taxable amount if they are not age 59 1/2 or older.

Please note that superior financings accumulate rate of interest. Income tax-free therapy likewise assumes the lending will eventually be pleased from income tax-free death advantage proceeds. Fundings and withdrawals minimize the policy's cash worth and survivor benefit, might create specific plan advantages or riders to become unavailable and may enhance the opportunity the policy might lapse.

A customer might certify for the life insurance, yet not the cyclist. A variable universal life insurance coverage agreement is a contract with the primary objective of supplying a fatality benefit.

What is the most popular Legacy Planning plan in 2024?

These profiles are closely taken care of in order to satisfy stated financial investment purposes. There are fees and charges connected with variable life insurance policy agreements, including mortality and risk costs, a front-end tons, administrative costs, financial investment monitoring charges, abandonment charges and charges for optional motorcyclists. Equitable Financial and its affiliates do not supply lawful or tax obligation guidance.

Whether you're starting a family or marrying, individuals typically start to think of life insurance policy when somebody else begins to depend on their ability to gain an income. Which's great, since that's specifically what the survivor benefit is for. As you learn much more regarding life insurance policy, you're most likely to find that numerous policies for instance, entire life insurance have greater than just a fatality benefit.

What are the benefits of entire life insurance policy? One of the most enticing benefits of purchasing an entire life insurance plan is this: As long as you pay your costs, your death advantage will certainly never ever end.

Believe you do not require life insurance coverage if you don't have youngsters? You might wish to assume once more. It might appear like an unneeded cost. However there are several advantages to having life insurance coverage, even if you're not supporting a family members. Here are 5 factors why you ought to get life insurance policy.

Where can I find Guaranteed Benefits?

Funeral costs, burial expenses and medical bills can accumulate (Premium plans). The last thing you desire is for your liked ones to bear this additional problem. Irreversible life insurance policy is offered in different quantities, so you can choose a survivor benefit that meets your demands. Alright, this one only uses if you have kids.

Identify whether term or long-term life insurance coverage is ideal for you. As your individual situations change (i.e., marital relationship, birth of a kid or job promo), so will your life insurance policy requires.

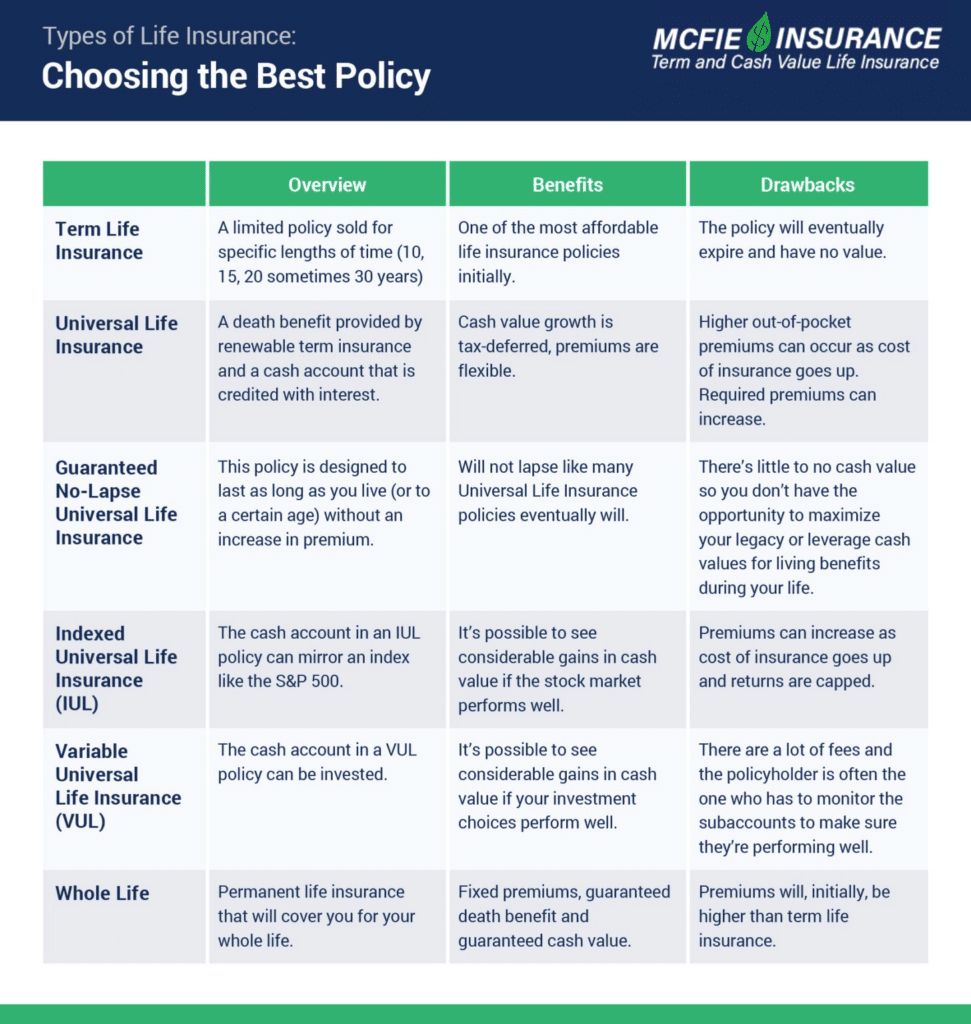

Essentially, there are two kinds of life insurance plans - either term or irreversible strategies or some mix of the 2. Life insurance companies provide different forms of term strategies and typical life policies along with "interest delicate" products which have become a lot more common since the 1980's.

Term insurance policy supplies security for a specified time period. This duration could be as brief as one year or offer protection for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or in many cases approximately the oldest age in the life insurance coverage death tables.

How can I secure Family Protection quickly?

Currently term insurance rates are very competitive and among the cheapest historically seasoned. It ought to be noted that it is an extensively held belief that term insurance is the least pricey pure life insurance protection offered. One needs to evaluate the plan terms meticulously to determine which term life choices appropriate to fulfill your specific scenarios.

With each brand-new term the costs is enhanced. The right to restore the plan without evidence of insurability is an important benefit to you. Otherwise, the threat you take is that your wellness might degrade and you might be unable to acquire a policy at the same rates or perhaps in all, leaving you and your recipients without coverage.

You have to exercise this alternative throughout the conversion duration. The length of the conversion period will differ depending upon the kind of term plan bought. If you transform within the prescribed duration, you are not needed to provide any information regarding your health. The costs price you pay on conversion is generally based upon your "present achieved age", which is your age on the conversion day.

Under a level term policy the face amount of the policy continues to be the very same for the whole period. Usually such plans are offered as home mortgage protection with the quantity of insurance coverage reducing as the balance of the home loan lowers.

What is the difference between Riders and other options?

Commonly, insurance providers have actually not deserved to transform costs after the plan is offered. Because such policies may proceed for several years, insurance companies need to make use of conservative death, rate of interest and cost rate estimates in the premium calculation. Adjustable costs insurance coverage, however, enables insurance providers to provide insurance at lower "existing" premiums based upon much less conventional presumptions with the right to transform these costs in the future.

While term insurance is designed to give protection for a defined period, permanent insurance is created to give coverage for your whole life time. To keep the costs price level, the premium at the more youthful ages exceeds the actual cost of defense. This added costs develops a book (cash money value) which helps pay for the policy in later years as the expense of protection rises above the premium.

Under some plans, premiums are required to be paid for an established number of years. Under other plans, costs are paid throughout the insurance holder's life time. The insurance provider spends the excess premium dollars This type of policy, which is occasionally called cash worth life insurance coverage, generates a financial savings aspect. Cash money values are important to a long-term life insurance policy.

Latest Posts

Instant Insurance Life Quote

Final Expense Insurance Quotes Online

Funeral Insurance Policy Cost